vehicle sales tax in memphis tn

What is the sales tax rate in Memphis Tennessee. There is no applicable special tax.

Hot Rod Volume 28 Issue 11 November 1975 Hot Rods Car Enthusiast Gift Rod

Maximum Local Sales Tax.

. Memphis collects the maximum legal local sales tax. You can print a 975 sales tax table here. Vehicle Sales Tax Calculator.

Old Courthouse 300 Main Street Knoxville TN 37902. All sales are subject to the standard Tennessee sales tax rate of 7 percent on the dollar. The minimum combined 2022 sales tax rate for Memphis Tennessee is.

View our landers used inventory to find the right vehicle to fit your style and budget. The type of license plates requested. Vehicle Sales Tax Calculator.

New South Memphis TN Sales Tax Rate. The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis tax. Motor Vehicles Title Applications.

IRSstate tax form -- W2 Forms Property tax receipts etc. M-F 8am - 5pm. Tennessee State Sales Tax.

Kingsport TN 37660 Phone. We provide a trained staff to assist you so that your visit to the Clerks Office will be as pleasant as possible. Express van car rental.

How 2021 sales taxes are calculated in memphis. The minimum combined 2021 sales tax rate for memphis tennessee is. County Clerk Main Office.

The state in which you live. The highest the combined citycounty rate can be is 275. Save up to 5559 on one of 58 used cars for sale in memphis tn.

Cities throughout the state have the option of imposing local taxes which can range from 15-275 depending upon the city and county you live in. The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. Tennessee collects a 7 state sales tax rate.

Memphis TN 38103 Phone. New car sales tax OR used car sales tax. 2020 rates included for use while preparing your income tax deduction.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. City Treasurers Information Line. Whether or not you have a trade-in.

WarranteeService Contract Purchase Price. M-F 8am - 5pm. Newbern TN Sales.

New Tazewell TN Sales Tax Rate. Obtaining a Title Transfer or New Vehicle Title Tennessee State law requires that any vehicle operated on the roads of Tennessee be properly titled registered and that appropriate sales tax be paid on the transfer of any vehicle whether purchased from an individual or a dealership. Average Local State Sales Tax.

Bristol TN 37621 Phone. In addition to the state tax local taxes can be assessed as well. This is the total of state county and city sales tax rates.

Rates include state county and city taxes. TENNESSEE SALES TAX AND OTHER FEES. Used Car Sales Tax In Memphis Tn.

The latest sales tax rates for cities starting with A in Tennessee TN state. Memphis TN Sales Tax Rate. A listing of the local tax rates for.

The county the vehicle is registered in. The sales tax calculator is for informational purposes only please see your motor vehicle clerk to confirm exact sales tax amount. There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes.

Between spouses siblings lineal relatives parents and children grandparents and grandchildren great grandparents and great grandchildren or spouses of lineal relatives. New Union TN Sales Tax Rate. Typically automobile and boat sales in Tennessee are subject to sales or use tax.

Exemptions to the Tennessee sales tax will vary by state. In addition to taxes car purchases in Tennessee may be subject to other fees like registration title and plate fees. The December 2020 total local sales tax rate was also 9750.

Property tax refunds are generally processed within 60 days after receipt of assessment change information from the Shelby County Assessor or the Board of Equalization and the appropriate submission of required documents to the City Treasurer Office. The current total local sales tax rate in Memphis TN is 9750. The few exceptions to this rule are when vehicles or boats are sold.

Title fees should be excluded from the sales or use tax base when Motor vehicle or boat is subject to the sales or use tax. Just enter the five-digit zip code of the location in. Many different issues can arise when titling and registering a vehicle in the State of Tennessee.

For Renewal Information Phone. What is the Memphis area Retail sales tax rate Memphis 3 replies Classic Car Inspector or Mechnic with Classic Car Experience Memphis 5 replies Sales Tax Cheaper in TN MS or AR Memphis 3 replies Tennessee sales tax Memphis 15 replies Visiting Memphis for the first timeHIGH SALES TAX Memphis 8 replies. From a sole.

Maximum Possible Sales Tax. For vehicles that are being rented or leased see see taxation of leases and rentals. WarranteeService Contract Purchase Price.

Tax and Tags Calculator.

With Open House Homes For Sale In Memphis Tn Realtor Com

Tn Dept Of Revenue Tndeptofrevenue Twitter

Cars For Sale In Memphis Tn Carsforsale Com

4675 Raleigh Lagrange Rd Memphis Tn 38128 Realtor Com

5626 Dedo Cir Memphis Tn 38135 Realtor Com

10 Pros And Cons Of Living In Memphis Tn Right Now Dividends Diversify

1745 Myrna Ln Memphis Tn 38117 Realtor Com

Sales Tax On Cars And Vehicles In Tennessee

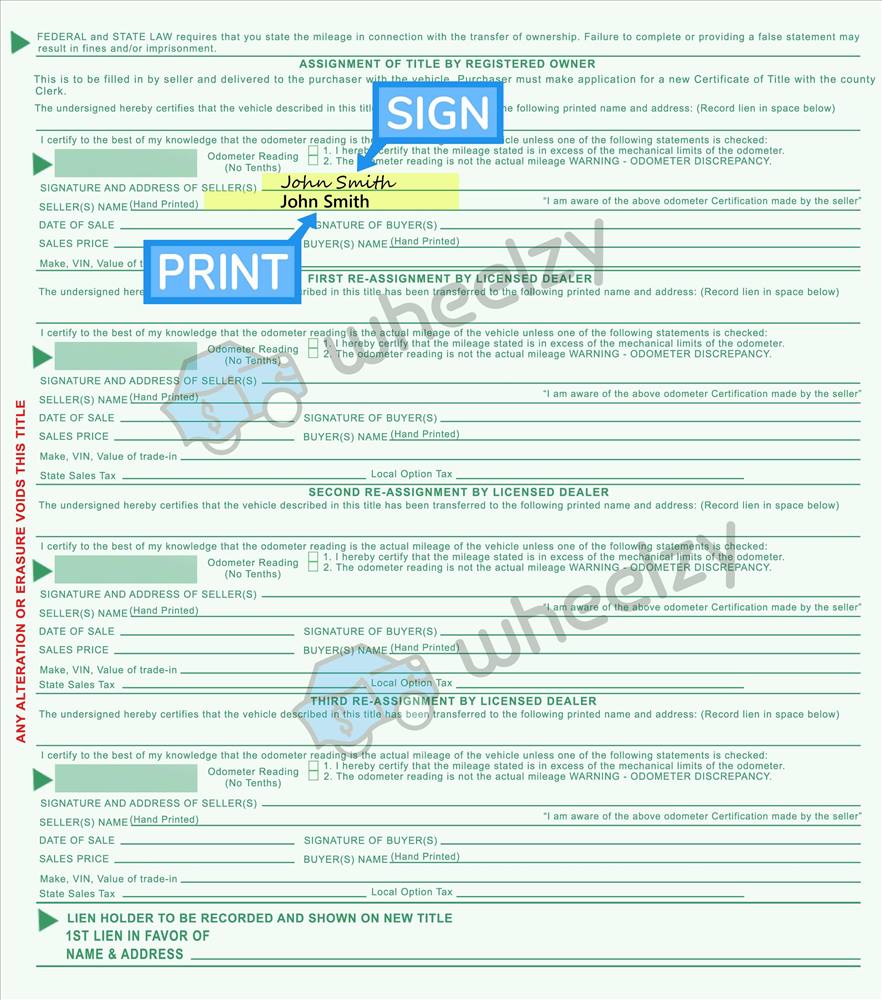

How To Sign Your Car Title In Memphis Including Dmv Title Sample Picture

Used Suvs In Memphis Tn For Sale

Suvs For Sale In Memphis Tn Carsforsale Com

Memphis Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1705 Quail Hollow Rd Memphis Tn 38120 Realtor Com

720 Sweetbrier Rd Memphis Tn 38120 Realtor Com

3620 Hallbrook St Memphis Tn 4 Beds 2 Baths Exterior Brick Memphis Real Estate Sales

1506 Birdsong Ave Memphis Tn 38106 Zillow

Railpictures Net Photo Mata 455 Memphis Area Transit Authority Mata Melbourne Metropolitan Tramways Board W2 At Memphis Te Memphis Metropolitan Tennessee