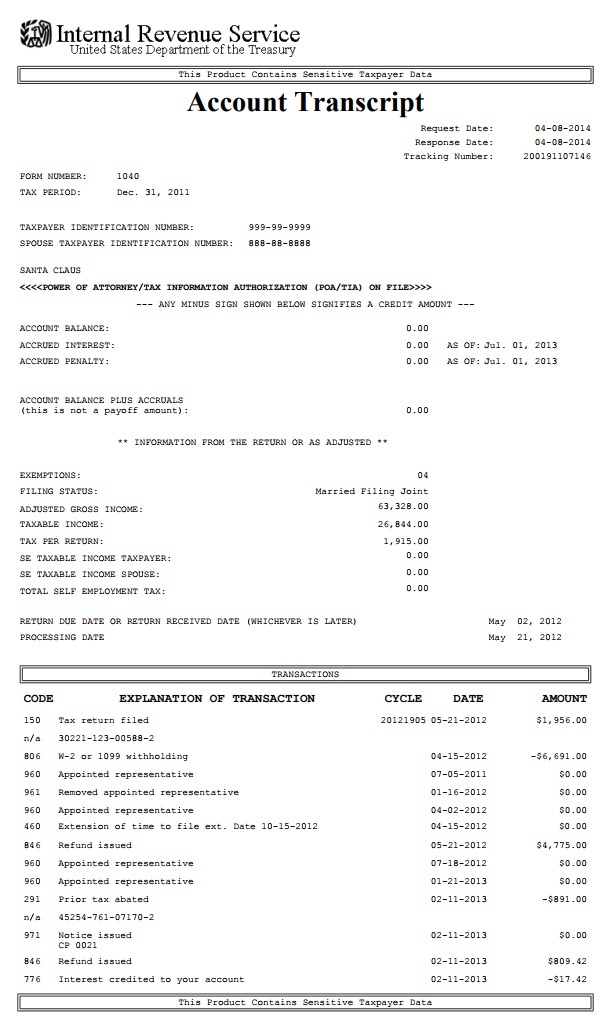

additional tax assessed by examination

Upon looking into my account online I found that I have been charged code 290 Additional tax assessed 240. Posted on Jan 7 2021.

Revision Exercise With Key Notes O Level Poa Assessment Book Tuition Syllabus O Levels

I was accepted 210 and no change or following messages on Transcript since.

. 421 closed examination of tax return 12102020 290 additional tax assessed. Agreement to Assessment and Collection of Additional Tax and Acceptance of Overassessment. The following is an example of a case law which defines an additional assessment.

Is the agreement form to be used in two situations. It is a further assessment for a tax of the same character previously paid in part. 290 means additional assessment of.

I received a notice from the IRS that I owed some taxes from 2017 of which I was unaware. Your Role as a Taxpayer. January 1 2016.

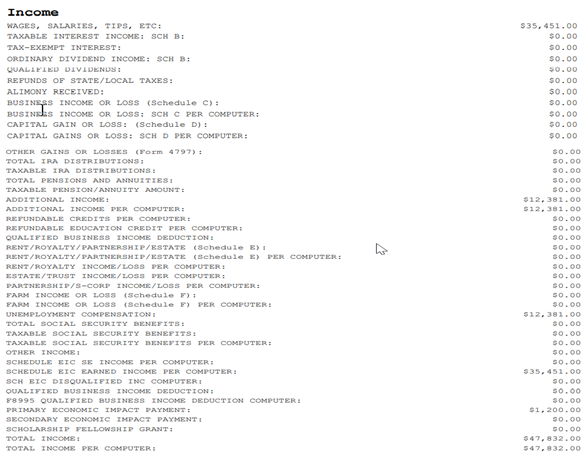

575 rows Additional tax assessed by examination. Possibly you left income off your return that was reported to IRS. If the taxpayer disagrees with the original determination he.

The process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid or a tax credit was reversed. Generates TC 421 to release 42 Holdif Disposal Code 1-5 8-10 12 13 34 and TC 420 or 424 present. Youll have to call the IRS for an explanation.

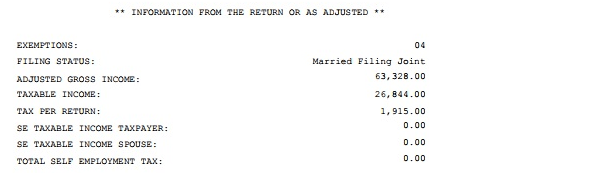

In employment tax examinations where any worker classification issue was examined and accepted and other non-IRC 7436 issues are adjusted. Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment. If a taxpayer files a return before the filing date for example a Form 1040 filed on April 12th for.

IRS says I owe an additional 7568 for the year of 2018 from Additional Tax assessed by examination. It may be disputed. After a return or report is filed under the provisions of any State tax law the director shall cause the same to be examined and may make such further audit or investigation as he may deem necessary and if therefrom he shall determine that there is a deficiency with respect to the payment of any tax due under such law he shall assess the additional taxes penalties if any.

Theres no way to tell just looking at the transcript. Assesses additional tax as a result of an Examination or Collection Adjustment to a tax module which contains a TC 150 transaction. Complete the following sentences by clicking on the correct answer.

Examination Coverage and Recommended Additional Tax After Examination by Type and Size of Return by Tax Year. Ask a lawyer - its free. Recommended Additional Tax and Returns with Unagreed Additional Tax After Examination by Type and Size of Return by Fiscal Year.

Just sitting in received. 442514 Quick Assessment Verification Form 3552 CCP or Campus Examination Procedures. Additional assessment is a redetermination of liability for a tax.

Code 290 Additional Tax Assessed on transcript following filing in Jan. Continue to Part 2 or to assess your answers click the Check My Answers button at the bottom of the page. As a general rule the IRS must assess additional tax and propose penalties no later than 3 years after either a tax return is filed or the returns due date whichever is later.

Download table_10_18pdf 70428 KB Download table_10_18xlsx 33126 KB June 29 2021. Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe. Download table_new_17pdf 25546 KB Download table_new_17xlsx 16118 KB June 29 2021.

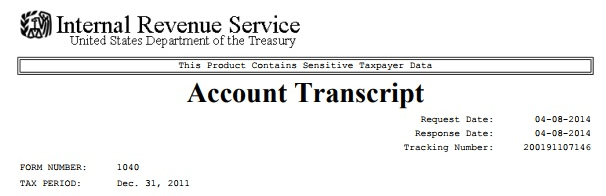

As tax professionals in Columbus Ohio we often assist taxpayers facing an Ohio Department of Taxation audit or examination or an IRS audit or examinationFor more information on. Individual Taxes Business Taxes. An assessment is the recording of the tax debt on the books of the IRS.

442515 Second Adjustment Document Form 5344 or Form 5403 CCP Responsibility. What do I do. You can request Wage and Income Transcripts from IRS httpwwwirsgovIndividualsGet-Transcript and compare the numbers reported to IRS.

Valrie Chambers PhD CPA. When the IRS selects a tax return for further study it carries out an. Additional Tax or Deficiency Assessment by Examination Div.

An audit reconsideration is defined by the Internal Revenue Manual IRM as. 442513 Follow-up on Quick Assessment Form 3210 CCP or Campus Examination Procedures. Additional Assessment Law and Legal Definition.

Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. This usually happens when SARS disallows some of your expenses and therefore issues an Additional Assessment showing the extra tax that is due. 4425141 Follow-up on Form 3552.

The tax attorneys at Nardone Law Group routinely represent individuals and businesses with various state and federal tax controversies such as tax audits or examinations. The term additional assessment means a further assessment for a tax of the same character previously.

Will I Get Audited If I File An Amended Return H R Block

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Irs Code 570 Solved What Does Code 570 Mean On 2022 Irs Tax Transcript

Irs Audit Appeal Or Protest Process Steps To Take To Appeal

About Tutor Mr Wynn Khoo For More Information Contact Admin Poatuition Com Sg Http Www Poatuition Com Tel 81356556 Tuition Tuition Centre Tutor

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Get Audit And Tax Services Mumbai Ahmedabad Nexr Tax Services Audit Tax

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

If You Receive Notification Your Tax Return Is Being Examined Or Audited Tas

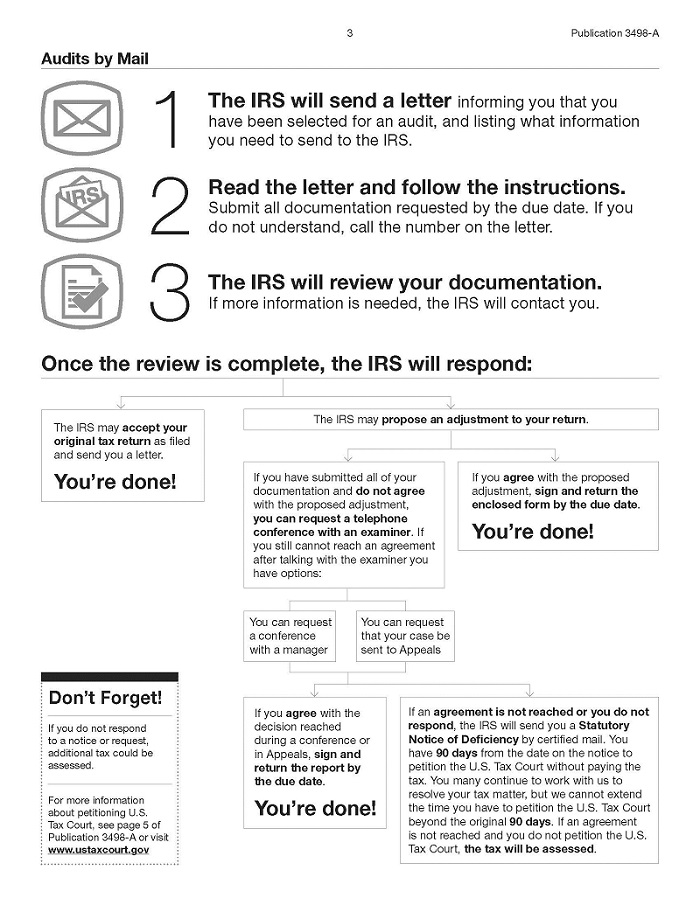

Audits By Mail Taxpayer Advocate Service

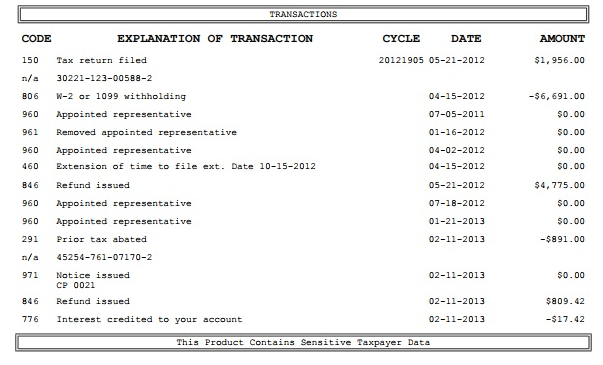

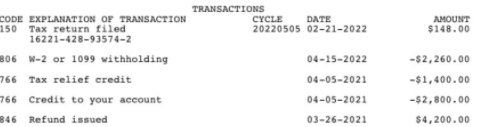

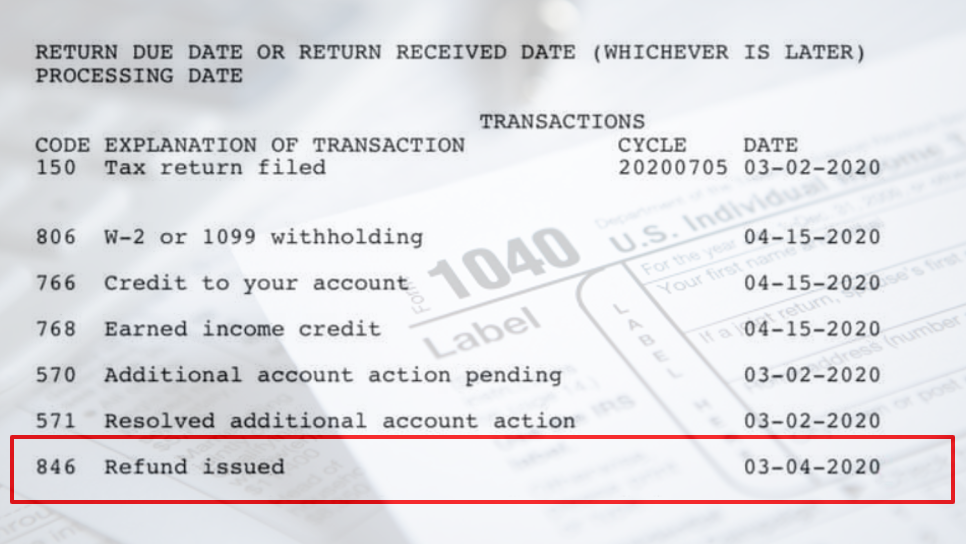

How To Read An Irs Account Transcript Where S My Refund Tax News Information

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Meaning Of Irs Tax Transaction Codes On Wmr Irs2go And Account Transcript For Your Tax Return And Refund Status 150 151 152 203 420 421 570 846 898 971 1121 1161 Aving To Invest

Meaning Of Irs Tax Transaction Codes On Wmr Irs2go And Account Transcript For Your Tax Return And Refund Status 150 151 152 203 420 421 570 846 898 971 1121 1161 Aving To Invest

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

How To Read An Irs Account Transcript Where S My Refund Tax News Information

How To Read An Irs Account Transcript Where S My Refund Tax News Information

How To Read An Irs Account Transcript Where S My Refund Tax News Information